Audits

State law requires West Virginia cities and other units of local government to undergo annual audits. These audits are generally performed by a private accounting firm approved by the state auditor, but they may also be performed by the state auditor’s office. For more information about the state auditor’s rules and procedures regarding the audit process, please visit their website.

Purpose & Timing

Purpose of an Audit

The purpose of a municipal audit is to verify the accuracy of the city’s financial statements by systematically examining the sources and uses of public funds. Auditors evaluate the accuracy of financial records, the effectiveness of systems protecting against fraud and theft, the nature of accounting methods and processes in use at the city, and other aspects of compliance with state law and government accounting standards.

Audits are performed on financial records from a time period known as a “fiscal year.” All governments in West Virginia use a fiscal year that runs from July 1 to June 30. The fiscal year is named for the year in which it ends. For example, Fiscal Year 2018 ran from July 1, 2017 until June 30, 2018.

Audits of a given fiscal year are typically completed during the first quarter of the following calendar year. The audit for FY 2018 (which ended June 30, 2018) would have been completed in early 2019, and so on.

The Process

The audit process begins each summer with a letter from the state auditor authorizing cities to begin the process of procuring an audit firm and providing a list of approved firms. The city’s Audit Committee then solicits and evaluates proposals from firms on this list. The evaluation process uses a score sheet published by the state auditor to assign points to the firms that submit proposals. The firm with the highest score is then selected to perform the city’s audit.

Next, the selected firm receives the city’s annual financial statements, which are published each fall. The firm examines these statements carefully and uses them to devise an audit plan, including questions to be answered and tests to be performed. Review the city’s financial statements.

Some of these questions are answered through correspondence and phone calls. Then, usually in January, the firm sends a team of accountants to visit city hall. Over the course of about a week, these accountants request records and interview staff members. One of this team’s tasks is the random sampling of transactions from the year under review, to ensure that the proper authorization, execution, and accounting records can be produced on demand.

Several weeks after this on-site visit concludes, the firm transmits the results of the audit to council.

Results

One of the most important questions to ask after an audit is whether auditors confirmed that the city is complying with all applicable accounting standards. Cities must comply with accounting standards published by the Government Accounting Standards Board, or GASB, and verifying this compliance is the main purpose of an audit.

The best result of an audit is what is called an “unmodified opinion.” Sometimes also referred to as an “unqualified” or “clean” opinion, an unmodified opinion indicates that auditors have found no misrepresentations of fact and no failures to follow appropriate accounting standards.

In addition to this overall opinion, audits also typically include findings and notes that express any concerns that auditors have about internal practices and other matters.

City of Elkins has received unmodified audit opinions every year since FY 2012.

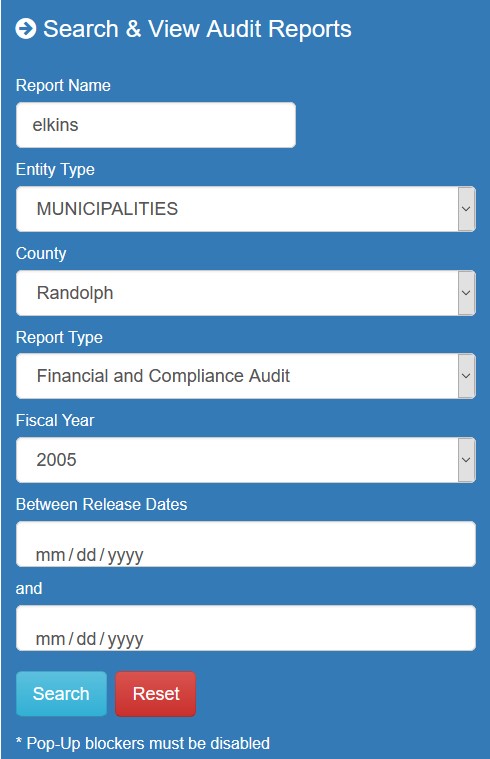

City of Elkins audits from FY 2005 or later may also be accessed through the state auditor’s website. On that page, fill out the search form (as shown here to the right), entering the specific year you are interested in, and click “search.” To find a specific year’s audit, it is not necessary to enter any values in the “between release dates” fields.

For More Information

Treasurer

Tracy Judy

401 Davis Avenue

Elkins, WV 26241

304-636-1414, ext. 1317 (office)

tjudy@cityofelkinswv.com