Update on Tax Increment Financing Process

Earlier this month, council voted to make application to the West Virginia Department of Economic Development for authority to form a Tax Increment Financing (TIF) district in Elkins. (See map at bottom of post.)

TIF is a mechanism created in state law to help cities and counties pay for needed projects when other financing is not available. At the heart of TIF is the concept of reserving future increases in property tax revenues for local use, while avoiding the need to increase property-tax rates. (Read more about TIF here.)

Applying for creation of the TIF district is the only step taken by council to date. Although the application requires enumerating possible projects that may be undertaken, the list of possible projects is amendable. The only projects that may be funded by TIF are those for which no other source of funding can be identified. (Click here for information about potential projects for redeveloping downtown Elkins.)

TIF funds may be accessed by issuing municipal bonds or through a process called pay-as-you-go. Issuing bonds would require separate council approval, along with justification of financial need and anticipated revenue collection.

Next steps in the TIF process:

- The city’s application is being reviewed by WVDED. The city should hear a response by sometime in March.

- If the application proposing to create a TIF district is approved, the city must then approve an ordinance doing so. It is currently estimated that such an ordinance could be finally approved by early April.

- Yet to come: decision about whether to issue bonds or use pay-as-you-go method, and how to most effectively apply revenues to the identified projects.

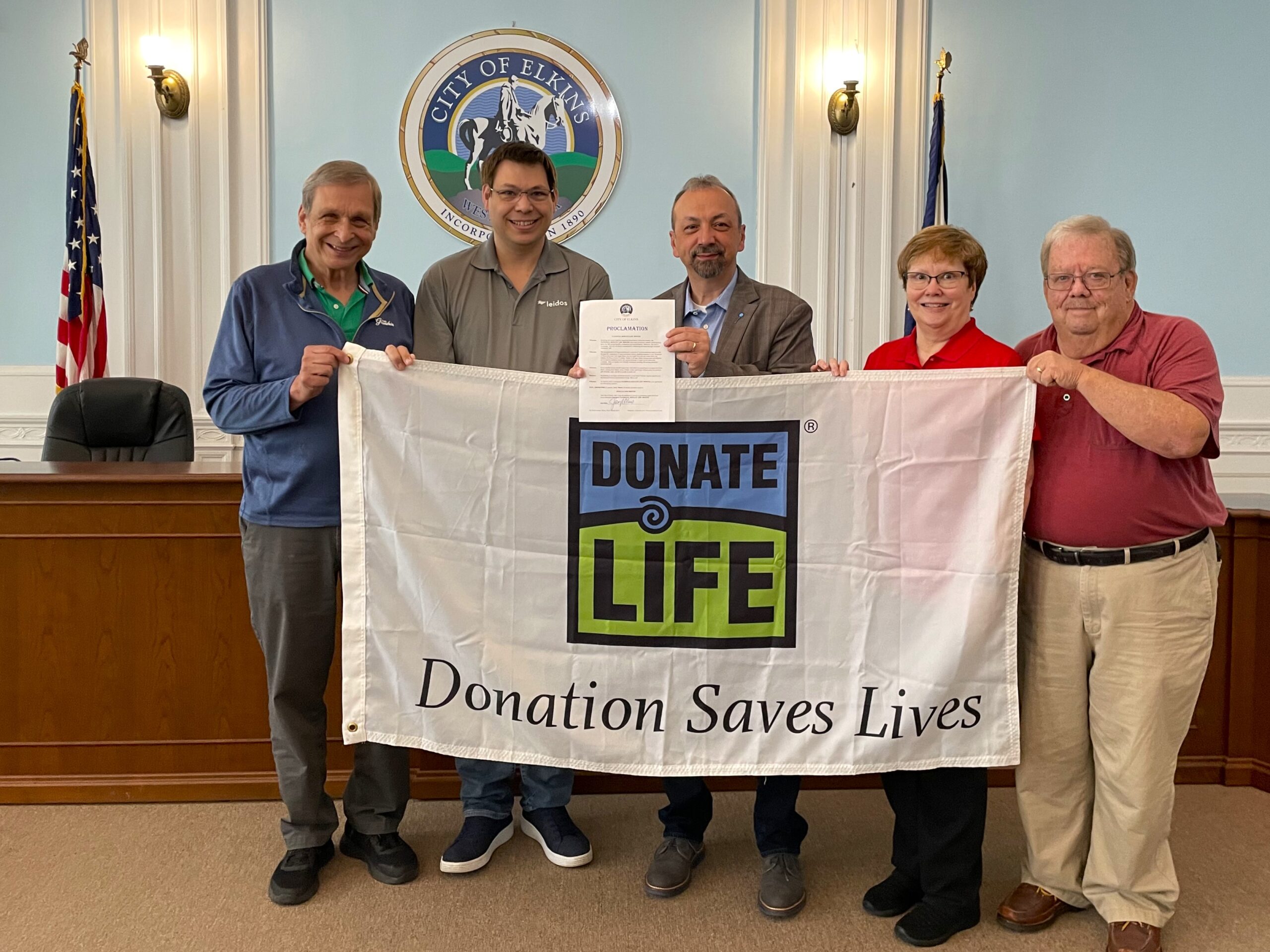

The Month of April Is Now Proclaimed Donate Life Month

Elkins W. Va., April 18, 2024: Mayor Jerry Marco has officially declared the month of April as Donate Life Month in the city of Elkins, West Virginia. This proclamation marks a significant step in raising awareness about the critical need for organ […]

Read More

Proclamation Declares May 2, 2024, as National Day of Prayer

Elkins W. Va., April 17, 2024: Mayor Jerry Marco has officially proclaimed May 2, 2024, as National Day of Prayer in the city of Elkins, West Virginia. This declaration honors a tradition deeply embedded in the history of America. The proclamation states […]

Read More

Proclamation Declares the Month of April as Child Abuse Prevention Month

Elkins W. Va., February 11, 2024: Mayor Jerry Marco has officially declared the month of April as Child Abuse Prevention Month in the city of Elkins, West Virginia. This proclamation comes as a critical step in raising awareness and fostering community-wide action […]

Read More

Ribbon Cutting Event for Pizza Hut Arcade

Elkins W. Va., March 26, 2024: On Tuesday, Elkins Pizza Hut announced the grand opening of its brand-new arcade, enhancing the dining experience with family fun for all ages. General Manager Michael Armstrong spearheaded the initiative to reintroduce video games into the […]

Read More

Fiscal Year 2025 Budget Information

Elkins W. Va., March 22, 2024: At Thursday’s meeting, Elkins City Council unanimously approved a General Fund budget for Fiscal Year 2025 that is about $600,000 more than the FY 2024 budget and maintains the city’s property-tax rates at current levels. Fiscal […]

Read More

Elkins Launches New Emergency Notification System

Elkins W. Va., March 20, 2024: The City of Elkins is pleased to announce the implementation of a new mass notification system aimed at strengthening emergency communication capabilities within the community. This system will enable the city to disseminate crucial information to […]

Read More